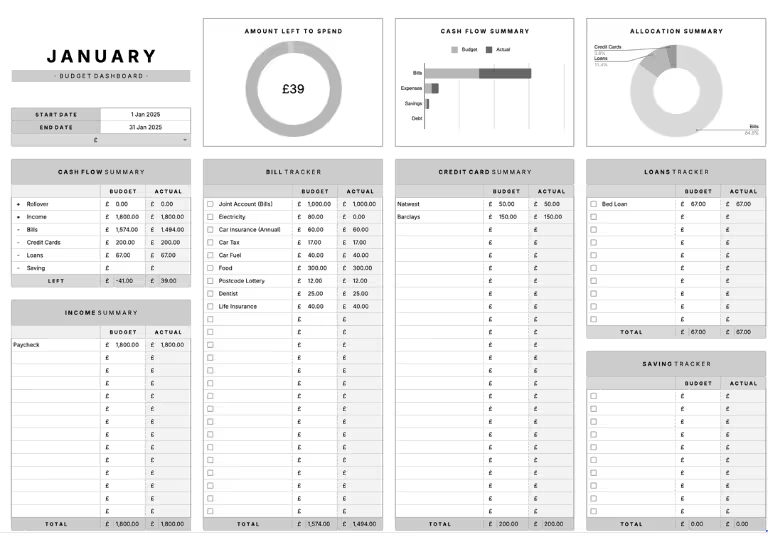

Free Budgeting Template (Google Sheet)

This FREE Google Sheet was made with the intention to give you a super easy way to get your budget up and running. It’s not full of thrills or fancy graphics. Just a base for you to start tracking your income/expenses/debt and to ensure that your money is working for you.

All you have to do is click the picture below (or here) and you’ll be able to copy the budget and start making changes!

Why a budget helps (especially in the UK)

Money in the UK rarely leaves your account evenly. Rent or a mortgage hits on one date, council tax on another, energy bills change, and then there are the “once-a-year” costs that pop up and sting.

A good budget gives you the basics:

- a clear view of your monthly money

- a plan for bills and everyday spending

- space for savings and goals

- a buffer for life’s “oh no” moments

It’s not about perfection. It’s about control.

What makes a 12-month budget template more useful than a one-month budget

A one-month budget can feel tidy, but it often hides the real problem: irregular costs. Annual car insurance. Christmas. School uniforms. Boiler repairs. MOT and servicing. Subscriptions you forgot existed. Those are the expenses that derail people, not the weekly food shop.

A 12-month budget template helps you spread those costs across the year. Instead of getting hit with a £360 insurance bill in one go, you plan for it by saving £30 a month. Same cost, far less stress.

That’s why our template is built for real UK spending – not just “income minus bills”.

What you can use this free budget template for

This template is designed to be flexible, whether you’re:

- trying to stop living payday to payday

- saving for a house deposit, a holiday, or a baby

- getting on top of credit cards or overdrafts

- managing a mortgage, rent, or shared household costs

- preparing for seasonal bills (winter energy, back-to-school, holidays)

It’s also useful if your income changes month to month (overtime, freelance, commission, benefits). You can plan using a “minimum income” baseline and then decide where any extra should go.

The simple way to fill it in (without overthinking it)

Start with your take-home pay (and any other regular income). If it varies, use a cautious estimate — the lowest “normal” month.

Next, list your fixed essentials:

- rent or mortgage

- council tax

- gas/electric

- water

- broadband/mobile

- insurance

- travel costs

- childcare

- minimum debt payments

Then add your everyday spending categories:

- groceries and household items

- petrol / public transport

- eating out / coffees

- clothing

- entertainment

- health and fitness

Finally, add the stuff people forget:

- birthdays and Christmas

- annual subscriptions (Prime, gym, streaming, software)

- car maintenance/MOT

- home repairs

- school costs

- holidays

- pets

The template makes room for these so you’re not “surprised” every time they show up.

A quick example: spreading a yearly cost

Let’s say you pay:

- Car insurance: £480 a year

- MOT + service: £300 a year

- Christmas: £600

Total annual irregular costs = £1,380

£1,380 ÷ 12 = £115 a month

That means if you set aside £115 each month, those big bills become routine instead of stressful. This is the heart of 12-month budgeting.

Budgeting when you’ve got a mortgage (or you’re aiming for one)

If you have a mortgage, budgeting matters because it protects the one payment you can’t afford to miss.

A template like this helps you:

- keep mortgage payments “ring-fenced”

- plan for rate changes, renewals, or higher costs

- handle homeowner extras like repairs, insurance, and maintenance

- build a buffer so one bad month doesn’t turn into a bigger problem

If you’re saving for a deposit, budgeting is how you find the spare cash without guessing. It also helps you prove you can manage regular payments, something lenders tend to like.

Build in an emergency fund (even if it’s small)

An emergency fund isn’t a luxury. It’s what stops a car repair turning into a credit card balance that hangs around for years.

If “3-6 months” feels impossible, ignore that for now and start with a smaller target:

- £100

- then £500

- then one month of essentials

A budget template makes this easier because you can treat saving like a bill, something that happens automatically, not only when you remember.

Common budgeting mistakes (and how to avoid them)

A budget usually fails for boring reasons – not because you’re “bad with money”.

People forget irregular costs.

That’s why a 12-month view is so powerful.

People underestimate spending categories.

Be honest. If you spend £100 a week on food, put £100. A budget that looks good but isn’t true won’t help you.

People don’t review it.

Set a quick monthly check-in. Ten minutes. That’s all it needs.

People don’t leave any breathing room.

If every penny is assigned perfectly, one unexpected expense wrecks it. Even a small buffer category helps.

A quick note on support

This is information, not personalised financial advice. If you’re struggling with debts or need tailored help, it’s worth checking MoneyHelper for free, UK-based guidance.